What Disasters Does Home Insurance Coverage Cover? For home owners, many property owners' insurance plan cover typhoon and hurricane damage. Service insurance that covers cyclones and cyclones commonly falls under a commercial residential or commercial property insurance plan. Similar to property owners' insurance policy, this coverage shields physical possessions, such as buildings, tools, supply, and various other residential or commercial property, from damage triggered by typhoons or various other cyclones. You can purchase a separate, government-sponsored policy for floodings-- aptly calledflood insurance policy-- through the nationwide flooding insurance program. In these cases, you may need to supplement your plan with a hurricane or hurricane recommendation. Oklahoma home owners insurance policy is by far one of the most pricey in the nation. Typically, property owners pay $3,659 each year, or $305 regular monthly, for $250,000 in house coverage. While its tornado toll is lower than Texas, which has regarding 155 hurricanes each year, Oklahoma has a tendency to have more powerful hurricanes and is less than half the size of Texas. Home owners additionally Vehicle coverage options have the alternative to add optional insurance coverage consisting of responsibility insurance policy and personal property coverage. Without responsibility home insurance policy, an owner can be personally responsible for covering lawful bills and losses sufferers incur after injury. And without personal effects coverage, homeowners would certainly need to pay to change all their ownerships after a loss. Purchasing these sorts of home insurance coverage is essential for those who can not pay for to cover these expenses on their own. At Obrella, our group of experts consistently updates our data source with the current information on natural calamities, including their places, seriousness, and damages costs.

Flood Insurance Policy

At CNBC Select, our objective is to offer our readers with top notch solution journalism and thorough customer guidance so they can make educated decisions with their cash. Every insurance testimonial is based upon strenuous coverage by our group of specialist writers and editors with comprehensive knowledge of insurance coverage items. Personal effects defense is usually marketed based on a portion of the plan's value. In a lot of cases, it costs even more to reconstruct a home than the house deserves.- Like hurricanes, cyclones can create both damages to a house, various other frameworks and individual possessions.The recent wildfires in The golden state are an additional good example of exactly how an all-natural catastrophe can harm a home.Getting flooding insurance policy is a necessity if you stay in a flooding simple marked by FEMA because of the high probability of experiencing flooding.

Your Burning Concerns Answered: Frequently Asked Questions On All-natural Disasters And Insurance Policy

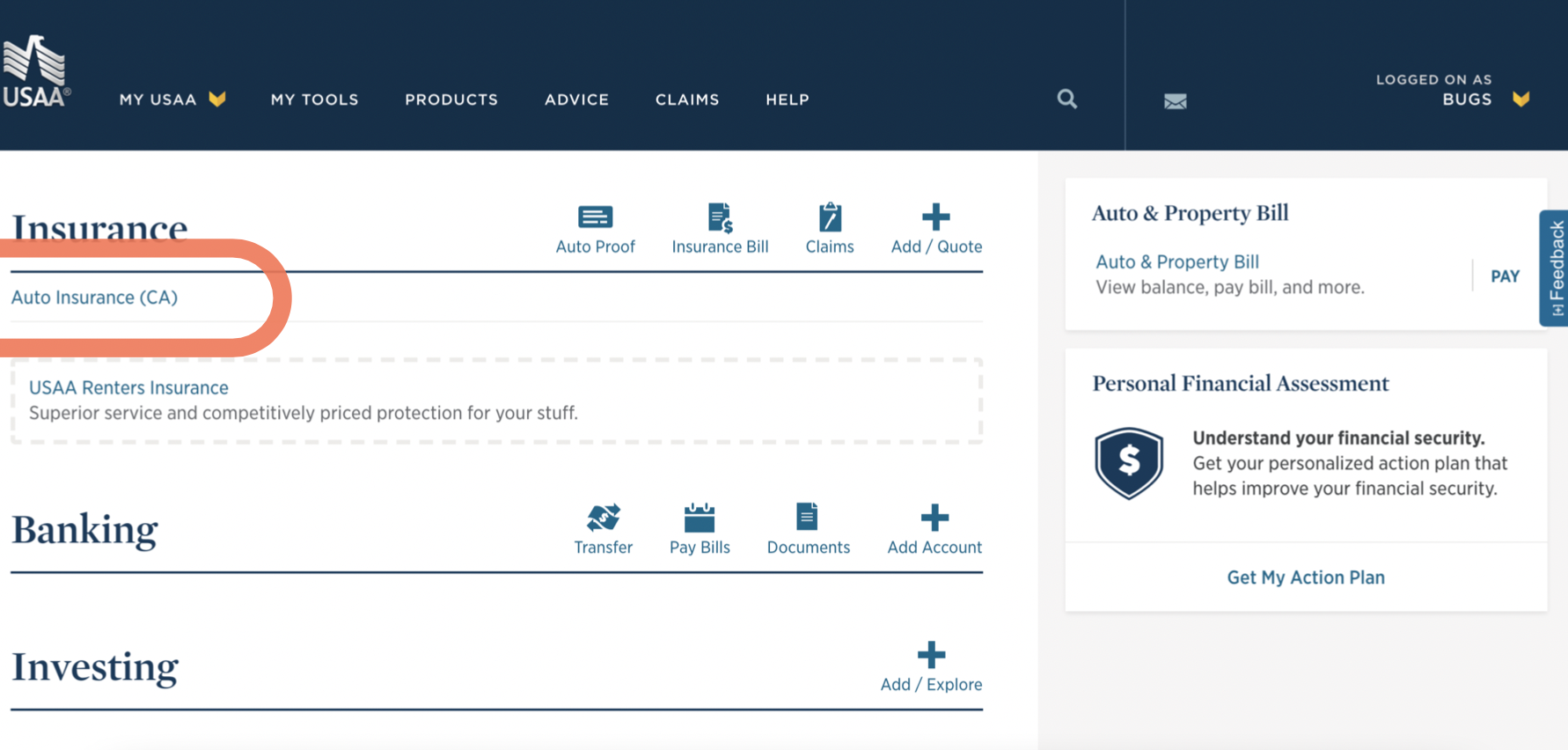

Wildfires can cause substantial damage to homes and homes, especially in states with completely dry environments and abundant forestland. Determining the states most impacted by wildfire damage costs can help house owners in those regions understand the possible influence on their insurance coverage rates. Through our considerable research study and evaluation, we unveil the states most impacted by flooding damages in 2023. By recognizing which areas go to higher danger, you can take positive steps to secure your home and possessions, including protecting ideal flood insurance protection.Hurricane Ian is a reminder for all homeowners to check their insurance for coverage of natural disasters - CNBC

Hurricane Ian is a reminder for all homeowners to check their insurance for coverage of natural disasters.

Posted: Thu, 29 Sep 2022 07:00:00 GMT [source]